The Kenyan government, through the treasury, has developed M-Akiba, a project that will allow investments in government securities through mobile devices.

The project is set to go live on the 23rd March 2017.

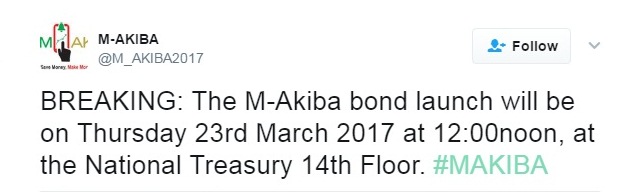

Below is the official announcement made on official M-Akiba twitter account:

Key stakeholders are expected to attend the event which will be held at the National Treasury.

The Kenya Association of Stockbrokers and Investment banks are expected to send representatives.

The launch is expected to be officiated by the Cabinet Secretary for National Treasury Hon. Henry Rotich.

This platform will allow micro-investors to buy government securities with as low as Ksh. 3,000 via their mobile phones.

Additional amounts can be invested in multiples of Ksh. 100. It comes with an interest rate of 10% per year.

This is quite attractive since, at present, the minimum investment amount is Ksh. 50,000.

The maximum investment per day for is Ksh. 140,000 for one person.

The bond has already been listed in Nairobi Securities Exchange (NSE) less than a month after its launch.

NSE says that the bond will be traded in denominations of Ksh. 500 and is expected to go through the normal share trading pattern.

Geoffrey Odundo, NSE CEO has confirmed that the listing has been advised by the large subscription rates.

The three-year bond is valued at Ksh. 150 million and is the first of its kind in the world. No other platforms selling bonds via mobile money platform exist.

This is definitely a chance for investors with small amounts of money to lend to the government instead of letting their money lie idle in the banks.

The best thing about this is the 10% tax-free interest rates that supersede the little or no interest earned from banks and mobile wallets.

The M-Akiba platform will likely intensify competition for cash deposits with banks and Saccos.

Currently, the bonds market is dominated by financial institutions and rich people; hence, the platform is expected to open this market.

The average Kenyan has been locked out of this market for long but no longer.

Should M-Akiba succeed, the government will be more than happy to break free from the dominant status of banks as its main domestic lender.

At the moment, banks hold over 50% of government securities whose values are over one trillion.

The platform will allow the government to access cheap loans.

The national debt keeps growing and the costs of foreign debts are high. The mobile-phone-based bond is, therefore, a savior, in a way.

The decision to integrate such a service with mobile platforms is definitely advised by the high penetration of mobile phones in the country.

The local mama mboga is no longer locked out of this investment opportunity.

The M-Akiba idea has been in the works for over two years but its launch has been postponed severally as the Treasury was trying to work out some modalities.

The Central Depository & Settlement Corporation (CDSC) will be the agent in charge of the M-Akiba sales. Earlier, bonds were issued by the Central Bank.

What do I need?

By now, you must be asking how and where to start: Well, for starters you must have a national ID or have a registered mobile line with either Safaricom or Airtel.

If you have an Orange line or any other lines, you cannot use it as the two service providers are the only mobile network providers participating in this.